Trends in Cloud IT: G Suite vs. Office 365 and the Meteoric Rise of SaaS Applications

October 5, 2016

7 minute read

Over the past five years, we have surveyed more than 10 thousand IT professionals.

Our goal is simple: We want to understand how technology is changing the way we work, and more importantly, how this transformation affects IT.

By mid-2017, large enterprises expect to have adopted 52 SaaS applications on average. That’s what we learned last year by surveying thousands of IT professionals for Trends in Cloud IT, our award-winning research series that examines that adoption of cloud and SaaS applications.

This year we’ve surveyed 1,535 people (949 IT professionals) from around the world. And over the next few months, we’ll use beautifully simple visualizations to highlight our 2016 Trends in Cloud IT data at length.

This post will look through the lens of Google Apps (now G Suite) vs. Office 365 to address the:

- Undeniable shift to cloud IT

- Obvious shift towards an “always cloud-first” mindset

- Acceleration of SaaS application adoption

- Increasing SaaS management challenge for IT professionals

- Budget constraints around SaaS security

- Pattern of SaaS adoption by application category

- Demographic similarities and difference of G Suite and Office 365 customers

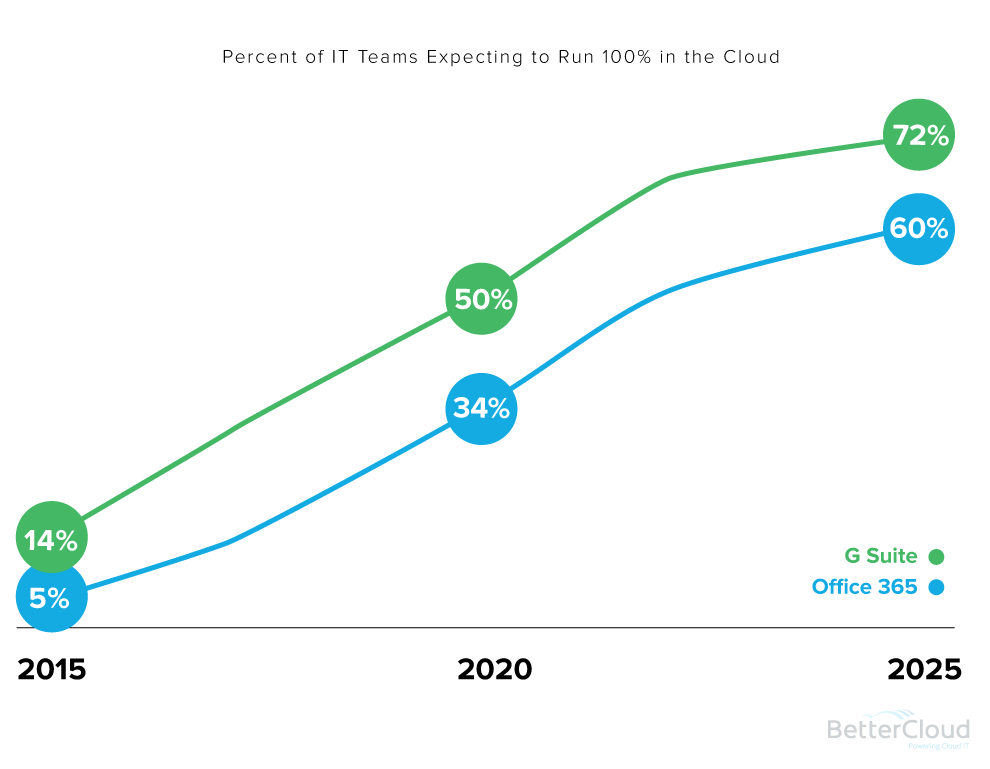

The working world is crossing the chasm toward running 100% of their IT in the cloud.

Last year we discovered that by mid-2015, 14% of G Suite organizations and 5% of Office 365 organizations ran 100% of their IT in the cloud. These innovators have paved the way for the early majority of organizations that will move away from legacy systems and toward 100% cloud IT environments.

The trend is undeniable. And while the majority of Office 365 organizations won’t run 100% of their IT in the cloud for some time because of infrastructure complexity, SaaS applications are–and will continue to be–heavily adopted.

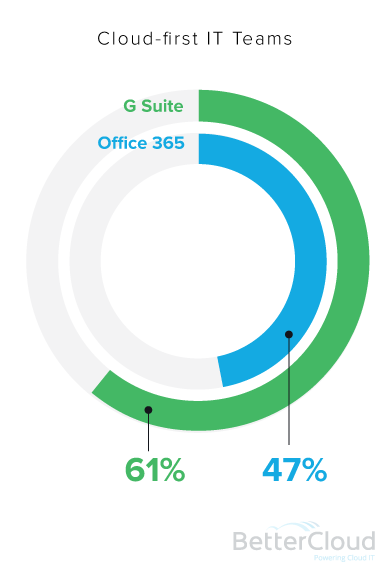

61% of G Suite and 47% of Office 365 IT teams are always “cloud-first.”

61% of G Suite and 47% of Office 365 IT teams are always “cloud-first.”

It should come as no surprise that G Suite organizations are more likely to “always be cloud-first.” What should come as a surprise is just how high the percentage is for Office 365 organizations. Clearly the shift to SaaS (and cloud IT in general) is a product of a growing cloud-first mentality among IT teams, regardless of whether they use G Suite or Office 365.

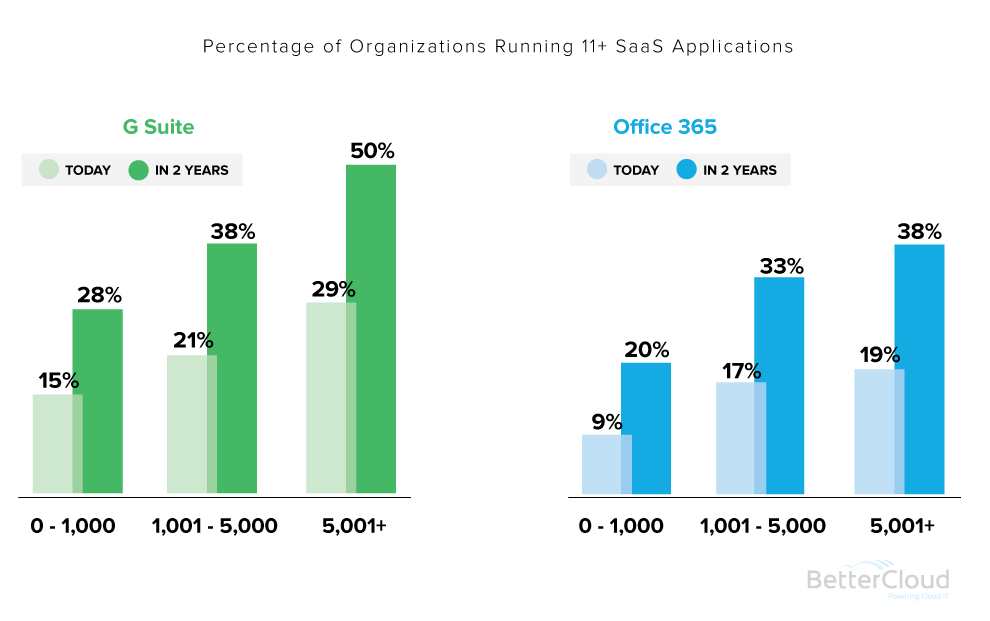

G Suite IT professionals are rolling out more SaaS applications than their Office 365 counterparts.

Despite G Suite organizations being significantly smaller in size, they still run more SaaS applications than their Office 365 counterparts. Today, 17% of all G Suite organizations run more than 11 SaaS applications. In comparison, 13% of Office 365 organizations run 11 or more SaaS applications.

As we look into the near future, SaaS application adoption shows aggressive growth. By 2018, 30% of all IT professionals expect to work for organizations running more than 11 SaaS applications.

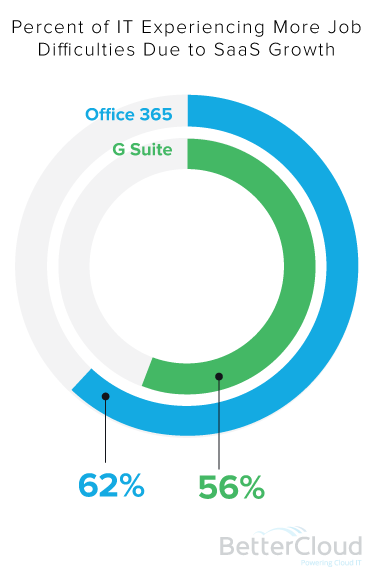

56% of G Suite and 62% of Office 365 IT professionals believe their jobs are becoming more difficult as their organization adopts more SaaS applications.

56% of G Suite and 62% of Office 365 IT professionals believe their jobs are becoming more difficult as their organization adopts more SaaS applications.

It’s easy to think that adopting SaaS applications will benefit the lives of IT. No servers, no problem. However, the majority of IT professionals do not believe this is the case.

Many IT professionals find comfort in working with legacy technology. These applications are accompanied with robust and mature management solutions (and best practices) that have taken years to develop.

On the other hand, the SaaS ecosystem is still young, and as a result, best practices are sparse and SaaS management solutions are still evolving. Today, IT must often rely on the management consoles provided by the SaaS vendors themselves, which receive far less attention than the products themselves–not to mention you must learn to navigate management consoles for each SaaS application.

As we explained in our 2016 State of Cloud IT Report, the rise of SaaS creates incredible complexity. In a nutshell, more SaaS applications means dealing with more vendors, more dashboards, more data, and more frequent updates. We call these heterogeneous environments.

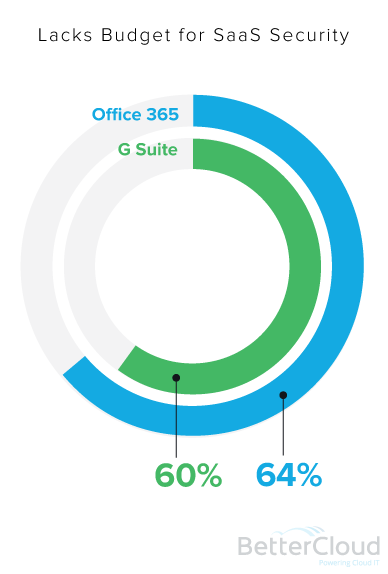

60% of G Suite and 64% of Office 365 IT teams lack adequate budget for SaaS application security.

60% of G Suite and 64% of Office 365 IT teams lack adequate budget for SaaS application security.

To add fuel to the fire, IT teams are strapped for cash when it comes to budget allocated to SaaS security. Given that many organizations have just begun to roll out SaaS applications, it makes sense that the budget to secure them is lacking. Most IT organizations probably don’t have SaaS management or security as a line item in their budgets.

If IT wants to continue to enable employees with SaaS applications, they are going to need the budget to secure and manage them.

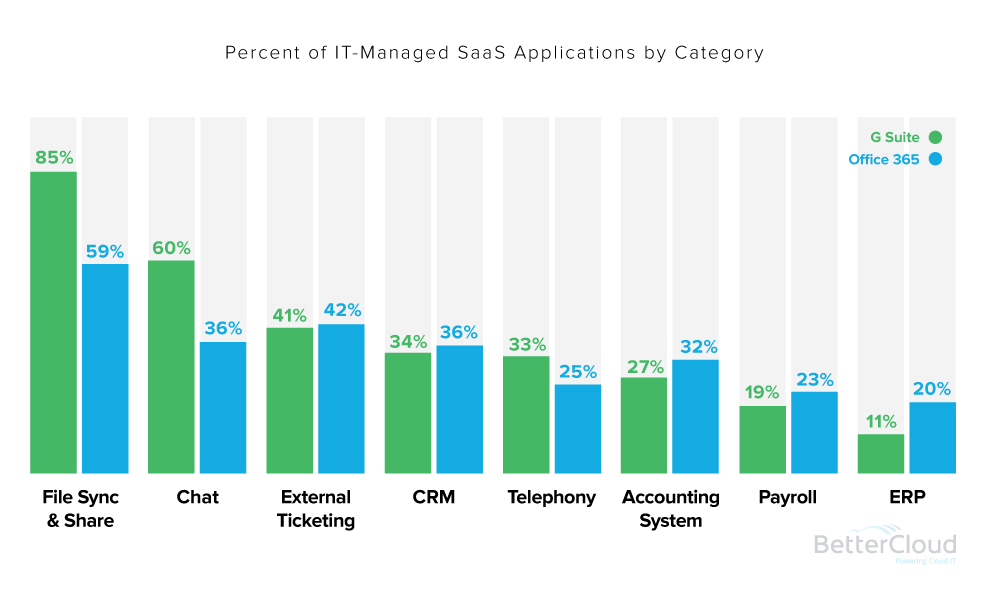

The IT world is adopting SaaS applications systematically.

When organizations shift to the cloud, many do so in phases, removing a legacy application and replacing it with its SaaS counterpart. The cadence of adoption follows a trend that shows file sync and share applications (e.g. Google Drive, OneDrive, etc.) and enterprise chat (e.g. Hangouts, Skype for Business, etc.) are often the first SaaS applications IT will officially sanction. Next comes external ticketing, CRM, and cloud-based telephony.

Why this order?

SaaS application categories that come standard with the G Suite and Office 365 systems are the most obvious first movers. Ironically, these applications house the majority of company data and are the most difficult to manage and secure.

In the end, it likely comes down to business impact. The applications that move to SaaS first are the ones that enhance collaboration across the organization and help drive and retain revenue.

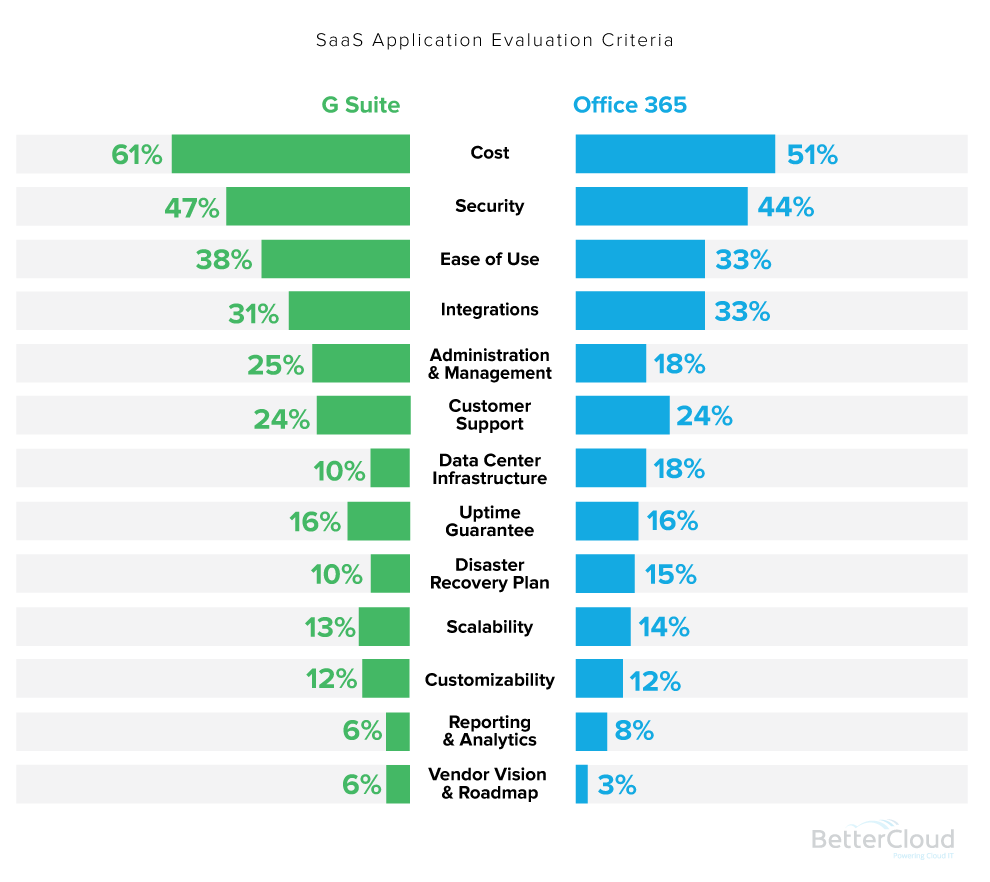

G Suite and Office 365 IT teams value cost and security above all else when evaluating SaaS applications.

Cost and security are far and away the number one criteria by which IT professionals choose their SaaS applications. Next are integrations and customer support.

Essentially, IT professionals want cheap and secure SaaS applications that are easy to use and offer strong integration capabilities. Administration and management of SaaS applications is the fifth most important criteria for G Suite and the sixth for Office 365 IT professionals.

G Suite and Office 365 IT professionals value purchasing criteria similarly. However, there are some slight, yet notable differences. Cost, ease of use, and administration and management capabilities are more important to G Suite IT professionals. Data center infrastructure and disaster recovery plans hold more weight for IT if they use Office 365.

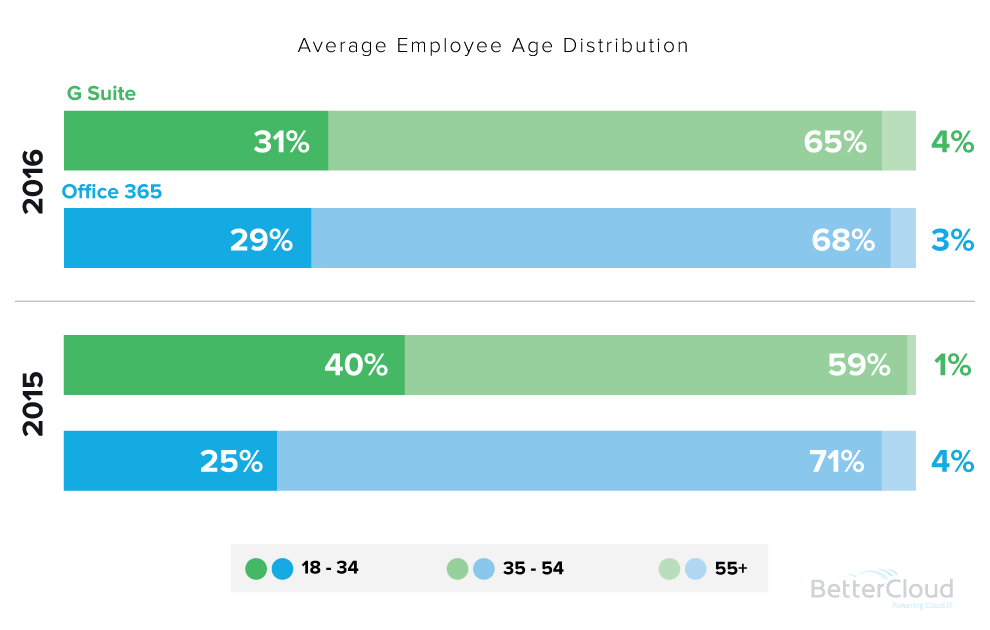

G Suite has lost its millennial edge.

Last year, we discovered organizations with young employee populations were far more likely to use G Suite than Office 365. In 2016, we see a nearly identical age distribution.

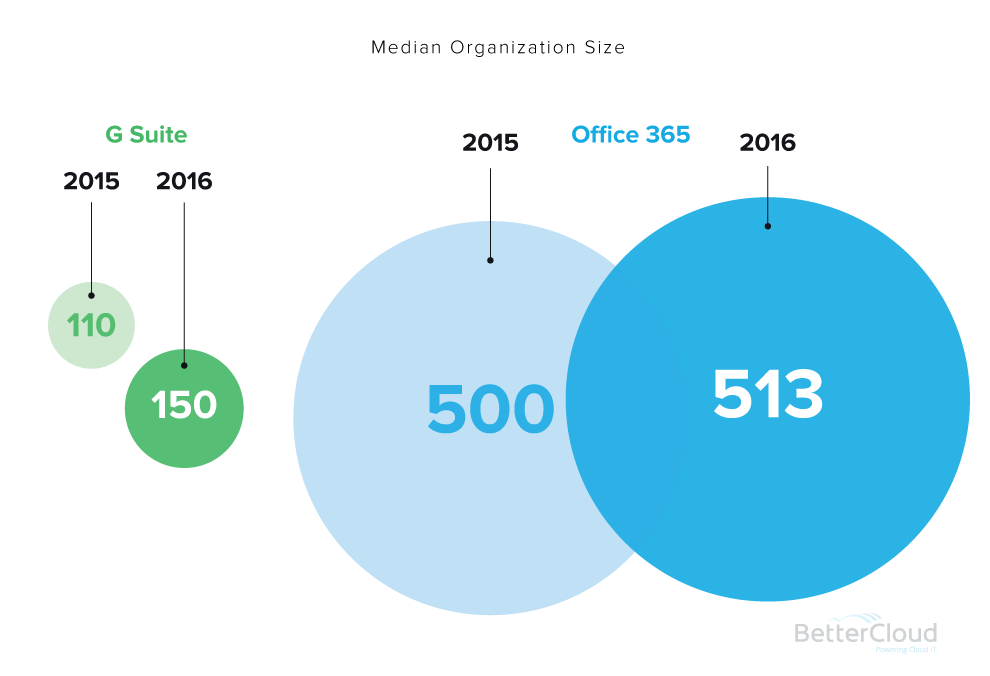

In most cases, Office 365 organizations are drastically larger than organizations using G Suite.

When comparing medians, Office 365 organizations were 355% larger than G Suite organizations in 2015. This year, the size gap closed by more than 110%. Office 365 organizations are a mere 242% larger in 2016.

Year over year, G Suite organizations grew 36% while Office 365 organizations grew just 2.6%.

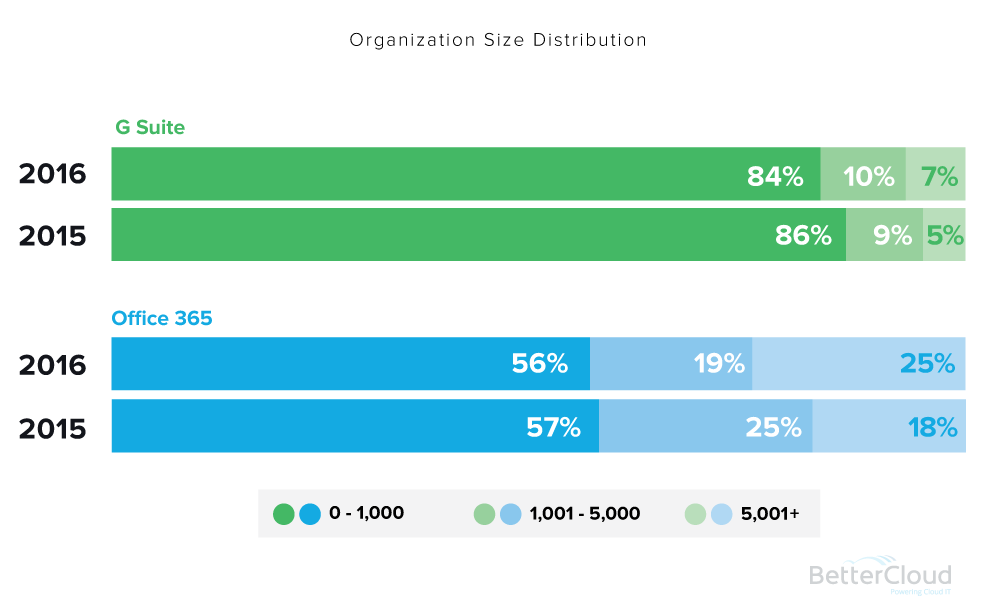

25% of Office 365 organizations have more than 5,001 employees.

When looking at which size segments our respondents fall into, we see a slight year-to-year shift for G Suite. Office 365 showed significant changes, especially when looking at organizations with more than 5,001 employees.

25% of Office 365 IT professionals work for large enterprises, up from 18% last year. A remarkably high number when you consider the vast majority (99.2%) of organizations are small businesses.

Just 7% of G Suite organizations have more than 5,001 employees, up slightly from 5% in 2015. 84% of G Suite organizations have less than 1,000 employees.

It will be fascinating to track these numbers over the next few years. Will Google make a more concerted effort to lure large enterprises? Or is their long-term strategy to entrench themselves in the small business sector and grow alongside the businesses they service?

Will Microsoft seek to become a more attractive small business solution to reel in the entrepreneurs of tomorrow? Or will their strategy continue to cater more toward established large enterprises?

More Trends in Cloud IT Coming Soon

We have an amazing amount of data to still explore and dozens of exciting findings we’ve yet to highlight. It’s honestly too much to put into a single post.

If you like this post, you’ll love what we have in store.

Subscribe to our newsletter to follow our ongoing Trends in Cloud IT series as we provide in-depth analysis that you can’t find anywhere else. You can also join BetterCloud Founder and CEO David Politis at Cloud IT Live on Oct. 25 as he discusses more Trends in Cloud IT in further depth.

61% of G Suite and 47% of Office 365 IT teams are always “cloud-first.”

61% of G Suite and 47% of Office 365 IT teams are always “cloud-first.”

56% of G Suite and 62% of Office 365 IT professionals believe their jobs are becoming more difficult as their organization adopts more SaaS applications.

56% of G Suite and 62% of Office 365 IT professionals believe their jobs are becoming more difficult as their organization adopts more SaaS applications.