How SaaS Economics are Changing the Partner Channel

September 10, 2015

9 minute read

It’s a critical time for many channel partners. The emergence of software as a service (SaaS)–and its inherent subscription-based pricing model–has led to numerous challenges, but also massive opportunity.

When the cloud first began gaining steam there were audible concerns from partners everywhere. Where will the channel fit now? What role will it play? Is there even a need for partners?

The partner channel has always played a significant role for software vendors. The cloud hasn’t changed that. But channel partners need to prepare their businesses for a new reality.

Cloud office systems (Google Apps and Office 365) along with other cloud applications like Salesforce and Box give a generation of workers advantages that were unimaginable just decades ago. Not only has the cloud had an unprecedented effect on the way we work, it’s also changed the way businesses procure products as well as how vendors and customers interact with partners.

In this post, we’ll explore the following:

The Importance of Recurring Revenue

The Impact of Churn

How Partners Can Help Prevent Churn

The Value of Customer Success

The Opportunities and Challenges for Partners

Meeting the Evolving Expectations of the Customer

The Importance of Recurring Revenue

Subscription-based pricing models stand in stark contrast to traditional license models. Customers now expect to pay in smaller increments throughout their usage of the product rather than ante up for a large one-time payment. And as the market shifts more towards SaaS business models, many in the channel are seeing revenue streams they’ve relied on for years begin to flow in new directions.

Because partner economics follow patterns similar to the economics of technology providers, it’s essential to know how the SaaS business model works–along with some of the core metrics and philosophies behind it.

This topic has been covered in great detail by many other experts in the field, so we will only cover the basics as they relate to channel partners. If you’re interested in learning more, much of what we will briefly cover here can be found on David Skok’s blog, ForEntrepreneurs.com. Skok is considered one of the foremost experts when it comes to building a successful SaaS organization.

There are some basic metrics that are extremely important for organizations building, selling, or reselling subscription-based offerings: Monthly Recurring Revenue (MRR)/Annual Recurring Revenue (ARR), Lifetime Value of Customer (LTV), and Customer Acquisition Cost (CAC).

Monthly Recurring Revenue (MRR)/Annual Recurring Revenue (ARR): In a subscription model, revenue is most often recognized ratably (evenly) over the life of the subscription. As a result, subscription-based revenue is highly predictable, which makes measurement of recurring revenue on a monthly and annual basis such a valuable metric for measuring the health of one’s business.

Lifetime Value of Customer (LTV): The dollar value generated from a customer minus the cost to service that customer (in financial terms, the gross profit contribution from a customer) over the life of the relationship. The most important aspect of LTV is how long a customer remains a customer or in other words, customer retention (churn).

Customer Acquisition Cost (CAC): There are different flavors of CAC (and names and acronyms), but the most common definition (and the one we subscribe to) is the cost of all Sales and Marketing expenses–from salaries, benefits, and payroll taxes, to internal SaaS applications, to travel and entertainment–divided by the total new customers in the same period. In other words, the fully-loaded cost to acquire a new customer in a period.

Together these metrics help SaaS organizations monitor the financial viability of their business. They help answer a very important question that all SaaS organizations should know: “Will I make or lose money on each additional new customer I acquire over the lifetime of that customer?”

The subscription model requires a major upfront investment (in CAC) to create a revenue stream that acts like an annuity. But unlike a true annuity, there’s no guarantees about how many years you’ll receive payment. Still, these metrics provide you with an outlook today and they can help tell you whether or not acquiring that annuity today will be profitable (or not) in the long run.

Because it’s possible to assume long-run customer profitability based on these metrics, and because of the highly recurring and predictable nature of the revenues, subscription businesses that have these metrics pointed in the right direction are very attractive to Wall Street as well as potential acquirers.

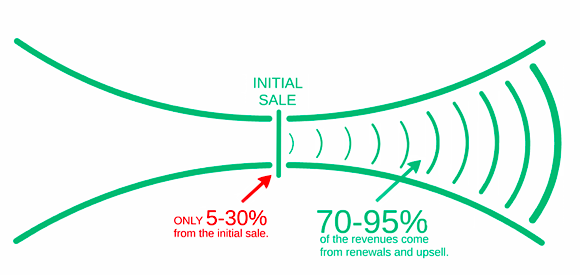

Image: Forentrepreneurs.com

Fancy acronyms aside, what these metrics are meant to emphasize is that there are two primary levers for influencing a subscription business: the costs to acquire a new customer (CAC) and the gross profit contribution from that same customer recouped over the customer’s lifetime (LTV). And of those, the most sensitive (meaning, the one that will most affect–for better or worse–financial viability and success) is LTV. In other words, few things matter more than customer retention.

SaaS vendors–and cloud partners–can build a strong recurring revenue stream by maximizing LTV and keeping LTV as a ratio to CAC within a good range. This will lead to economically-healthy MRR/ARR growth.

The Impact of Churn

Churn, or losing a customer to cancelation, is a huge concern for SaaS organizations–and for reasons we’ll explore later, an equally huge concern for the channel.

When a customer churns, not only does the annuity end but the potential for future upsells is also lost. Remember, a SaaS company acquires its recurring revenue (via CAC) at the start of a customer relationship. If that customer relationship is allowed to wither and that annuity is cut short, a SaaS company may find themselves upside down economically. If this happens frequently, the viability of the business model is at risk unless the trend can be reversed.

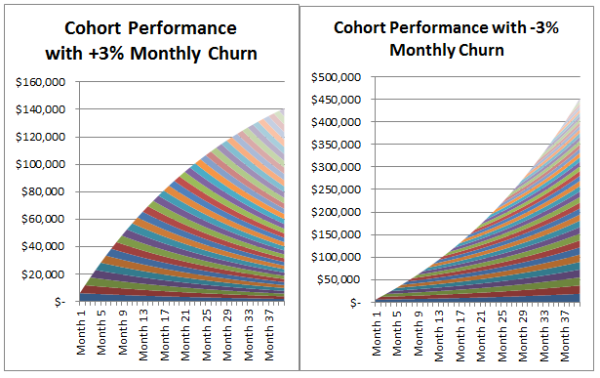

A low, or even negative churn (which is possible), is a pillar of SaaS success. Moderate churn rates can stunt growth dramatically and require considerable capital to grow (capital is needed to fund the upfront investment in CAC), and high churn rates are the death knell for businesses. On the other end of the spectrum, negative churn–achieved when upsells exceed lost revenue from churned customers–is the holy grail for SaaS companies.

Image: Forentrepreneurs.com

Regarding the graph above: “In the [left] graph, we are losing 3% of our revenue every month, and you can see that with a constant bookings rate of $6k per month, the revenue reaches $140k after 40 months, and growth is flattening out. In the [right] graph, we may be losing some customers, but the remaining customers are more than making up for that with increased revenue. With a negative churn rate of 3%, we reach $450k in revenue (more then 3x greater), and the growth in revenues is increasing, not flattening.” — David Skok, Forentrepreneurs.com

How Partners Can Help Prevent Churn

SaaS vendors and partners should never oversell product capabilities; few factors lead to churn faster than falling short of customer expectations set during the sales process. And, if customers aren’t using the product or are unsatisfied with its support, they’re also likely to churn.

This is why SaaS companies seek high engagement among customers and why proactive support, rather than reactive support is gaining steam. Partners can be valuable assets for SaaS companies in this regard, helping to fill the gaps with comprehensive training and best-in-class product support.

For SaaS companies, the best way to retain revenue–and grow it–is to provide an all-around great customer experience and ensure the product actually delivers value.

For partners, the same can be said; make sure that the services you layer on top of the products you sell actually add value. Otherwise, it becomes easy for a customer to churn to another partner even though they may not move away from the product itself.

Take the following two scenarios:

- A customer purchases Office 365 licenses through a Cloud Solution Provider (CSP) that simply sells the licenses and leaves the customer to deploy the suite and migrate from Exchange on their own.

- A customer purchases Office 365 licenses through a CSP, and even though they still want to deploy the suite and migrate from Exchange on their own, the partner offers other valuable services. The partner provides helpful documents and offers training for employees to teach them how they can leverage the collaboration features of Office 365. The partner also offers 24/7 support and a consolidated billing system for all of the customer’s SaaS solutions, like Salesforce, Box and Zendesk.

Which partner is the customer likely to be more loyal to?

The Value of Customer Success

In a SaaS business model, partners who help sell a product are often paid in perpetuity. This means MRR/ARR, LTV, and churn are concepts now commonly referenced in the partner channel.

These metrics, and the constant threat of churn, have led to an emerging discipline that is quickly becoming one of the most important tenets of the SaaS-based business model: customer success.

In a great interview with Openview Partners, customer success advocate, Lincoln Murphy of Sixteen Ventures, says customer success and the success of a business are linked. “Customer success is great for a lot of reasons, but one of its biggest benefits is that it provides a very clear view into the health of the company. If your customers are extracting value from your product or services, then you’ll extract value from them. It’s a very cyclical and mutually beneficial process.” He continues, “It’s customer success. You have to figure out what success means to your customers, and then deliver that value. Depending on who your customers are, what they care about, and what they need to be successful, that definition will be different for every company.”

The Challenges and Opportunities for Partners

Customer success, churn, LTV, CAC, and MRR/ARR are all characteristics of a SaaS organization, and now they represent the new reality for cloud partners. Together they are creating a myriad of challenges that the channel must overcome, but more importantly, they offer opportunity.

Challenges:

- In the SaaS model, revenue is spread out over the lifetime of the customer relationship. This means that once CAC has been earned back, every subsequent month and year is profit (on a unit-economics basis). For partners that typically earn 15-30% margins, the discipline of this approach is even more important.

- Ease-of-implementation typically implies less need for assistance as organizations routinely roll out SaaS products with no outside help. Often cloud applications can be integrated by a non-technical employee in a matter of minutes, making on-site integrations much less common and often unnecessary.

- In order to become or remain competitive in the marketplace, cloud partners must learn to overcome the challenges associated with the lower prices that cloud technology brings.

- For highly-specialized partners, SaaS is problematic because a single product or company can no longer completely dominate a market. The barriers to entry are much lower for SaaS vendors than in the past. For example, as of 2014, Salesforce owned just 16% of the cloud CRM market share. This fragmentation forces partners to avoid picking favorites, putting them in a tough spot and at risk of alienating existing partners. However, if agnostic, partners give themselves a much larger market to service, and a much greater opportunity to find customers.

Opportunities:

- Now is the time for channel partners to assert themselves as thought leaders and become strategic advisors to their customers. Rather than only being called upon when a problem arises, the partner channel has the chance to establish themselves as true partners to their customers’ success.

- The cloud is still uncharted territory for the majority of organizations. Companies will look to the channel to help guide them towards success in the cloud. Partners that can create an identity as a capable cloud navigator with the ability to boost productivity, collaboration, and security will become market leaders.

- In the past, organizations only used a handful of on-premises applications–and they were likely from only two or three vendors. But in the coming years, organizations are going to be using dozens–sometimes hundreds–of cloud applications, the majority of which will come from different vendors. And even though single integrations between one cloud application and another may be simple, integrating several cloud applications with one another and ensuring that the data flow is correct is much more complex. This will lead to a huge opportunity for partners to provide much higher value integrations at a much higher price.

- For resellers, SaaS is an opportunity to build a healthy recurring revenue stream. Dave Key, Director of CloudStrategies.biz wrote a great article about how SaaS has revolutionized the channel. In it, he quotes Taylor Macdonald, VP channels at Intacct, who says the following about the effects of SaaS on the channel: “The economics are different. The VAR used to get a percent of the initial purchase and then a small amount for the ongoing maintenance in subsequent years. With SaaS they get a significant revenue stream year after year.”

Meeting the Evolving Expectations of the Customer

Offering computing power on-demand and providing products and services through the internet is still a relatively

new phenomenon, yet global SaaS revenues already surpass 100 billion dollars per year.

There are many reasons why businesses and consumers are choosing SaaS products, but perhaps the most important reason is the one that shapes the relationship between the vendor and customer: the ability to control their own destiny. Consumers in a subscription model have the ability to control how much software they wish to consume, and as a result, how much money they wish to spend. The many benefits stated above and the numerous benefits left unmentioned are why the business world is moving away from on-premises software and toward the cloud.

The cloud isn’t replacing the need for partners, it’s simply redefining their role. To find success, partners must embrace the cloud and adapt to meet the new, evolving expectations of their customers.